Some Known Questions About Independent Financial Advisor copyright.

Wiki Article

Not known Details About Financial Advisor Victoria Bc

Table of ContentsSome Known Incorrect Statements About Tax Planning copyright 5 Simple Techniques For Investment RepresentativeInvestment Representative Can Be Fun For EveryoneThe 4-Minute Rule for Financial Advisor Victoria BcThe Definitive Guide for Private Wealth Management copyrightExcitement About Independent Investment Advisor copyright

Heath is an advice-only planner, this means the guy doesn’t control their consumers’ money immediately, nor really does he promote all of them specific lending options. Heath claims the benefit of this process to him is the guy doesn’t feel sure to offer a particular item to resolve a client’s money problems. If an advisor is only equipped to offer an insurance-based means to fix a challenge, they could wind up steering some one down an unproductive road within the name of striking sales quotas, he says.“Most financial services people in copyright, because they’re paid according to the items they feature market, they may be able have reasons to recommend one strategy over another,” he says.“I’ve chosen this program of motion because i will appear my personal clients to them and not feel like I’m using them by any means or attempting to make a sales pitch.” Story goes on below ad FCAC notes how you pay the consultant is determined by the service they give.

An Unbiased View of Independent Financial Advisor copyright

Heath along with his ilk are settled on a fee-only design, meaning they’re paid like a legal counsel can be on a session-by-session foundation or a per hour assessment price (investment representative). According to array of services plus the expertise or common customer base of your own specialist or coordinator, per hour charges can vary for the hundreds or thousands, Heath statesThis can be up to $250,000 and above, he says, which boxes around many Canadian homes using this degree of service. Story continues below ad For those unable to spend fees for advice-based strategies, and also for those reluctant to quit some of the investment returns or without adequate money to get started with an advisor, you can find less costly and even free of charge options available.

How Lighthouse Wealth Management can Save You Time, Stress, and Money.

Story goes on below advertisement discovering the right monetary planner is a little like online dating, Heath states: You want to find some one who’s reliable, has an individuality fit and is go right here also suitable individual for your level of life you’re in (https://www.cybo.com/CA-biz/lighthouse-wealth-management_50). Some choose their particular experts to-be more mature with a little more knowledge, he says, and others like someone younger who can hopefully stay with them from early many years through pension

The smart Trick of Tax Planning copyright That Nobody is Discussing

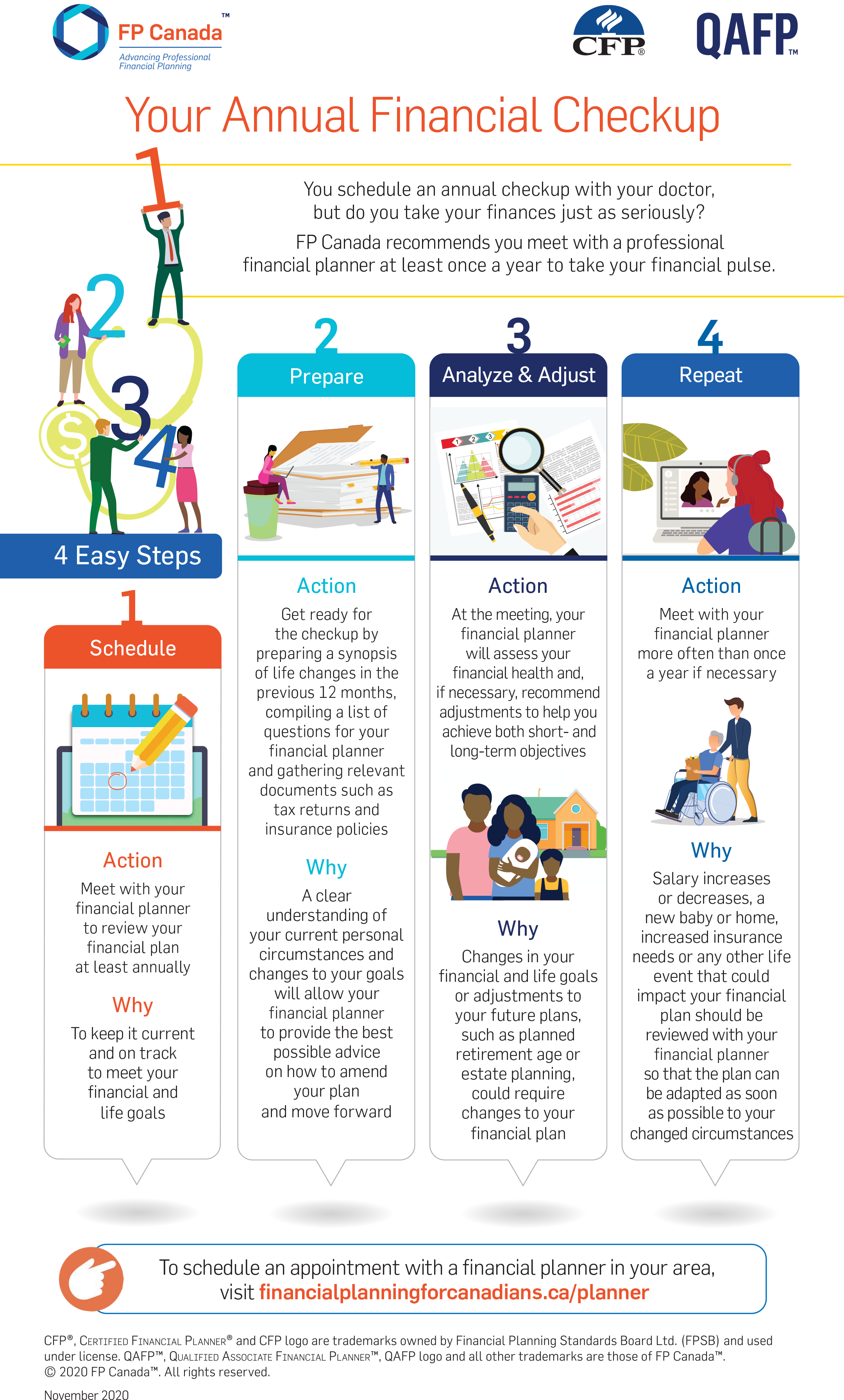

One of the primary errors somebody make in choosing a specialist isn't inquiring enough questions, Heath states. He’s astonished when he hears from clients that they’re anxious about asking questions and possibly showing up dumb a trend he discovers is simply as normal with founded pros and older adults.“I’m surprised, as it’s their cash and they’re paying lots of fees to these individuals,” he says.“You deserve to own the questions you have answered and also you need to own an unbarred and truthful commitment.” 6:11 Financial Planning for all Heath’s final advice applies whether you’re looking outdoors financial help or you’re heading it by yourself: educate yourself.Listed here are four facts to consider and get your self when figuring out whether you should touch the knowledge of an economic advisor. The web value is not your earnings, but instead a quantity that can help you comprehend exactly what cash you earn, how much cash it will save you, and for which you spend some money, too.

The Investment Consultant PDFs

Your infant is found on how. The separation and divorce is actually pending. You’re approaching pension. These as well as other major life activities may prompt the need to visit with a monetary advisor regarding your opportunities, your financial goals, and various other financial things. Let’s say your own mom left you a tidy amount of cash inside her will.

You've probably sketched out your very own financial strategy, but I have a difficult time keeping it. An economic advisor may offer the accountability you'll want to place your monetary intend on track. Additionally they may advise simple tips to modify your monetary plan - https://www.livebinders.com/b/3567174?tabid=aaafba60-2a7e-3bde-f5e7-f44030d8dc70 to be able to optimize the potential results

About Investment Representative

Everyone can state they’re a financial specialist, but an expert with specialist designations is actually essentially the one you really need to employ. In 2021, an estimated 330,300 Us citizens worked as individual financial experts, in accordance with the U.S. Bureau of work Statistics (BLS). Most financial advisors are freelance, the bureau says - investment consultant. Generally, you will find five forms of financial advisors

Agents typically obtain profits on trades they generate. Agents are managed by the U.S. Securities and Exchange Commission (SEC), the Financial field Regulatory Authority (FINRA) and condition securities regulators. A registered investment advisor, either people or a company, is a lot like a registered agent. Both trade assets on the behalf of their clients.

Report this wiki page